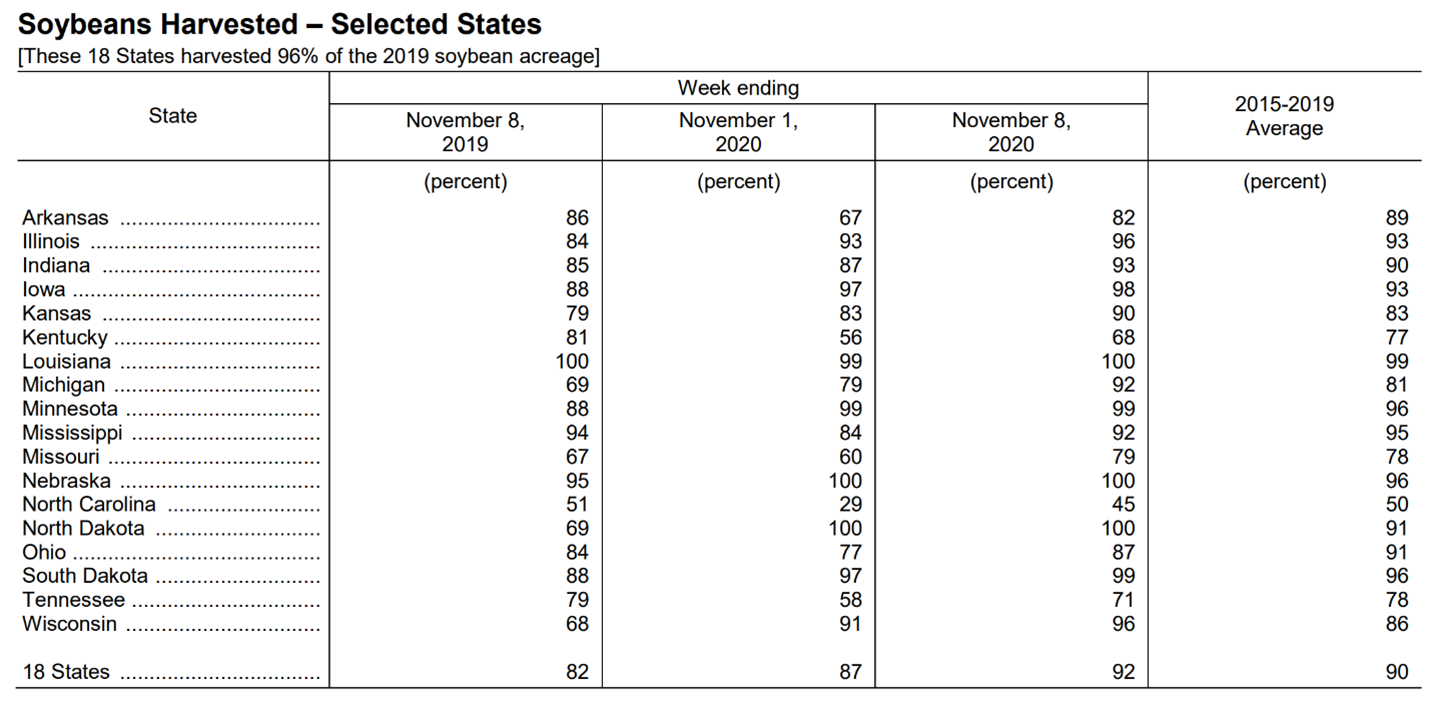

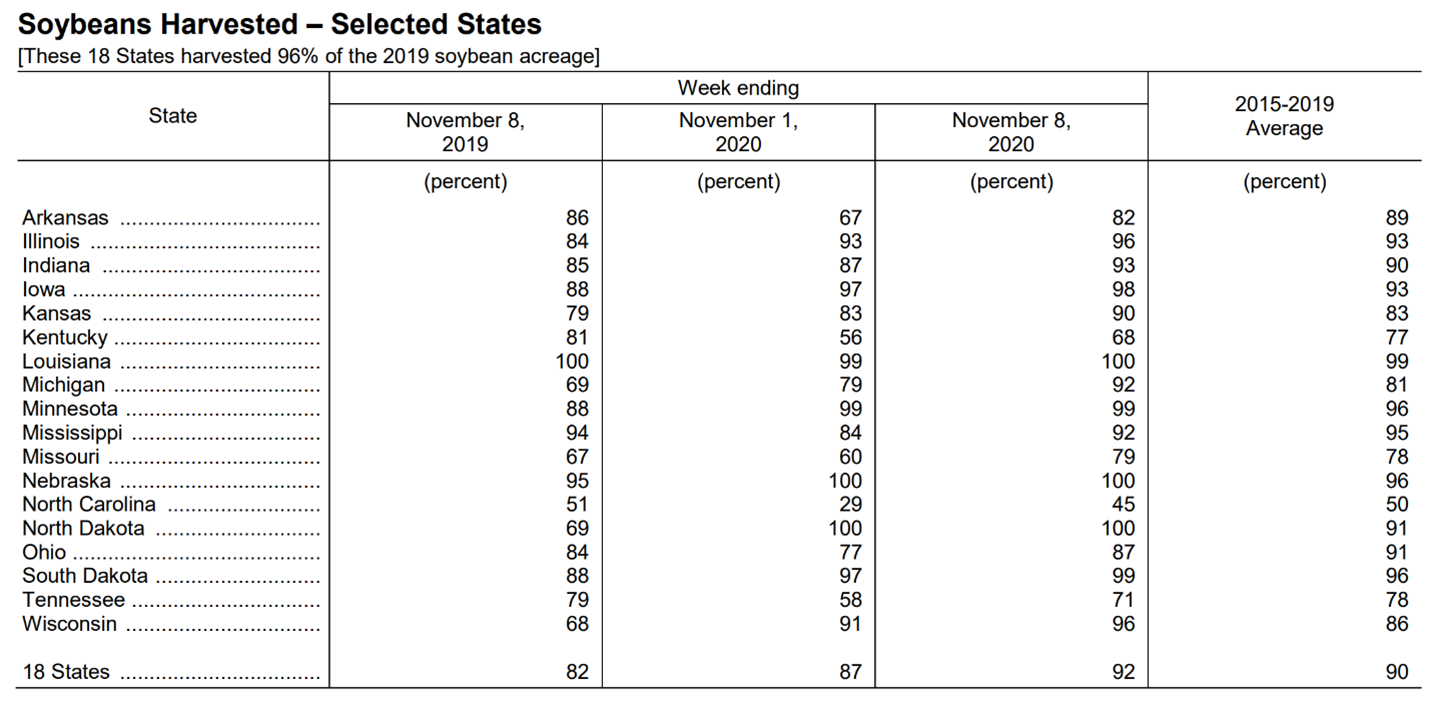

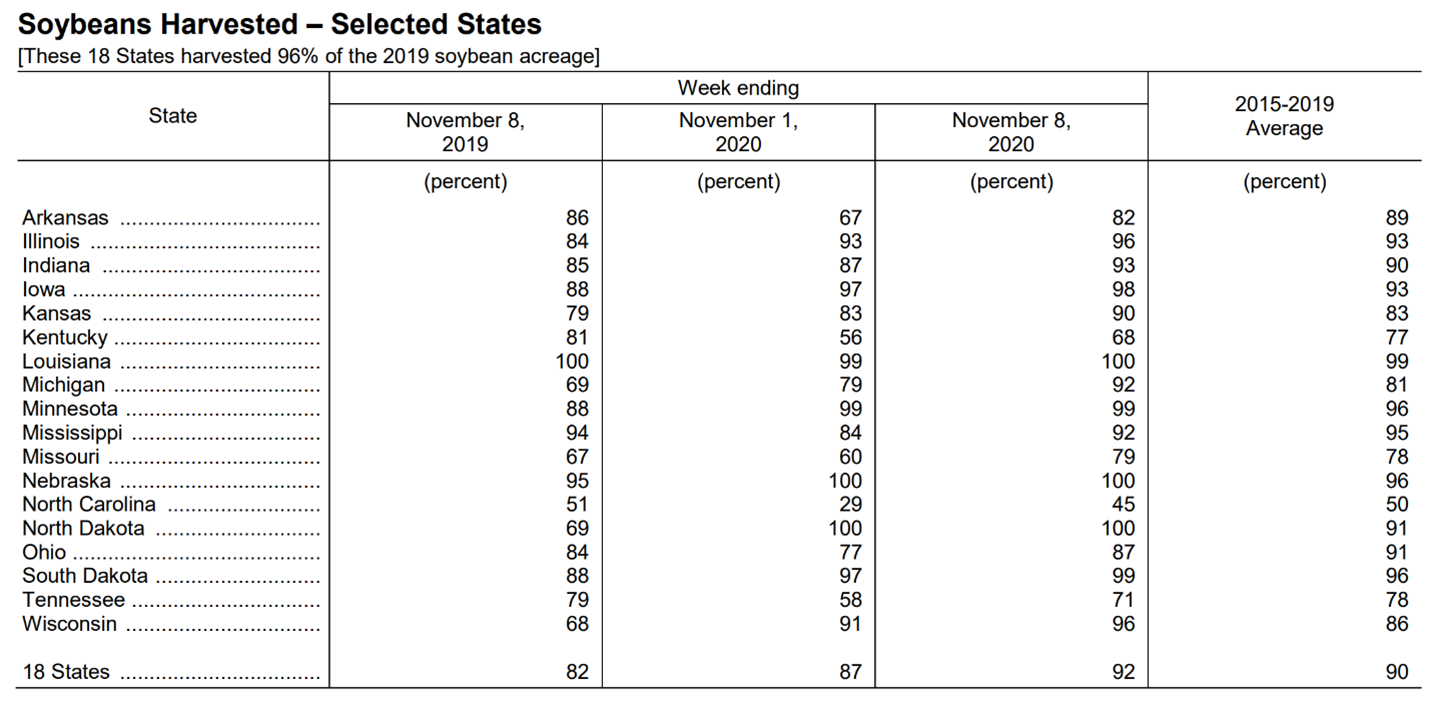

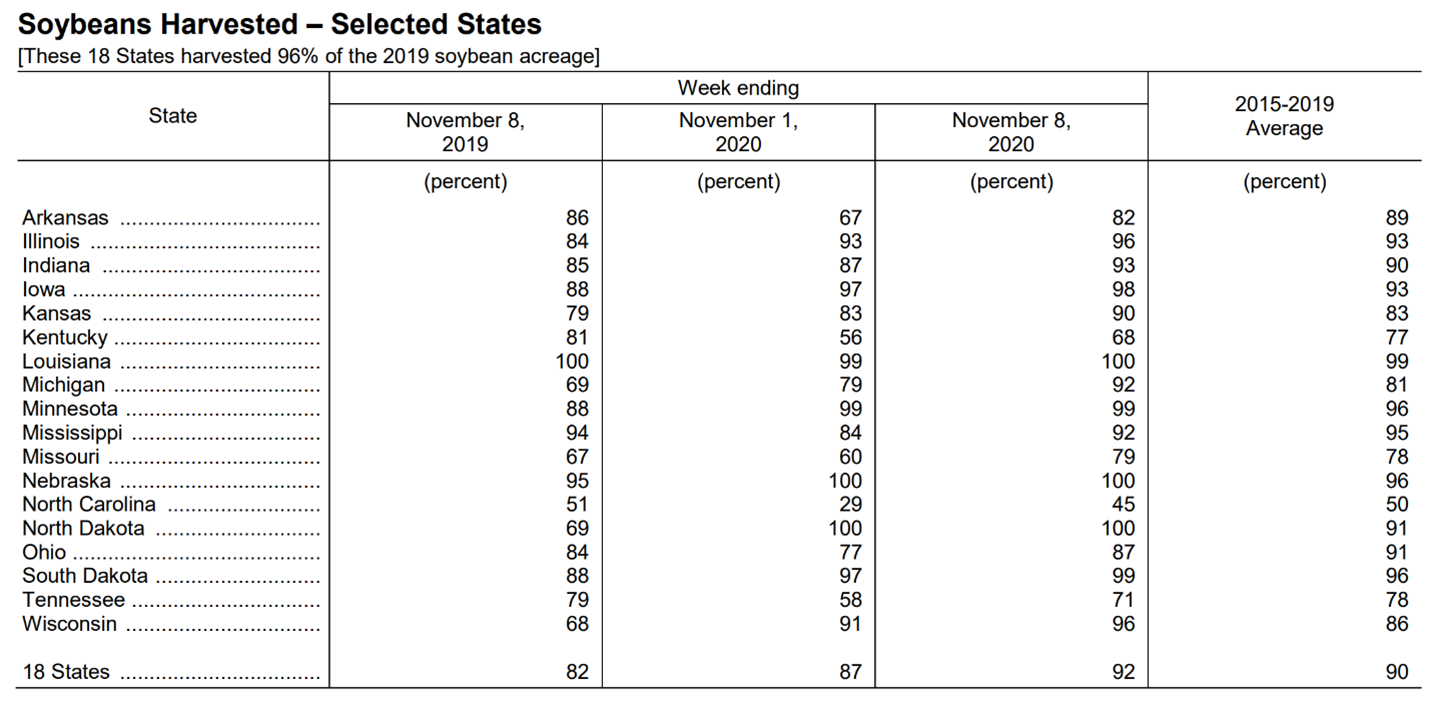

The November 9, 2020, USDA Harvest progress report indicates that, on average, the 18 states that are monitored are slightly ahead of the 5-year harvest average. Bringing the information closer to home, Illinois is about 96% (+/-) complete with harvest, with its 5-year average at 92%. For many Illinois soybean farmers, harvest has come and gone somewhat quickly.

Soybean plants were able to mature relatively nicely, allowing for harvest to begin earlier than usual. The benefit of early harvest in soybeans is that it allows for corn fields to have additional time to dry while overall harvest operations can begin. I have not gotten many reports of major harvest issues as it relates to soybeans such as quality (green beans or discolored). Talking with several soy farmers, it seemed like soybeans took a while to get dry and when they got dry, they really got dry fast. In some situations, harvest was held off a few days to allow for a rain or dew to set in, allowing for some additional moisture. To keep up to date on how Illinois and surrounding states are progressing follow this web address

https://usda.library.cornell.edu/concern/publications/8336h188j?locale=en

Now that harvest is done or will be shortly, it’s time to take a quick break, get back into the actual office and spend some much-needed time with your favorite spread sheet. In modern production agriculture for a farmer to stay in business short and long term, one must spend equal time with the business of farming as with the operation of farming. Below are some items to consider bringing some greater insight to the business side of farming.

Actions to consider:

1. Determine total bushels

a. Totals are good, but really need to break them down by how your crop insurance units are set up, also separated by farmers, fields and landlords.

2. Crop Insurance:

a. Now that you have your total bushels by farm and/or units, have your crop insurance agent(s) double check your policy for any potential payments that could be coming your way.

3. Fine tune Grain Marketing

a. How does your current outlook match with the plan that was originally set up?

b. Do you need to account for more bushels?

c. Do you need to account for more bushels sold at harvest?

d. Do you need to account for storing more bushes?

e. Do you need to account for more or less drying cost?

f. Do you need to account for more or less trucking cost?

g. Do you need to account for more or less storage cost?

4. Talk with Accountant

a. Believe it or not your Accountant or CPA is the gate keeper for taxes, depreciation, selling grain in a given fiscal year, and giving approval to spend some funds at the end of a year for capital improvements.