There are many reasons individuals decide to formalize their operation into a business entity. A variety of entity structures are available for business owners to use to accomplish the goals/objectives of their operation. Some operators use an informal operating joint venture instead of a formalized entity. Tax and transition planning are some of the most common goals of an entity. However, it is important to not only consider the tax implications but also keep in mind the overarching goals and strategic plan for your entity.

Common Entity Types

1. General Partnership

2. Limited Liability Partnership (LLC/LLLP)

3. Corporation

• C – Corporation or S – Corporation

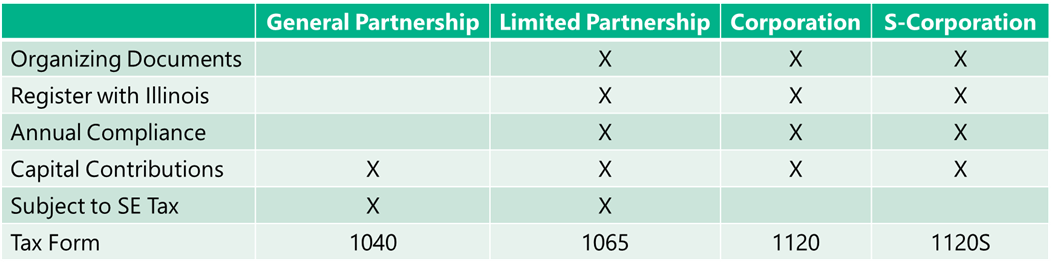

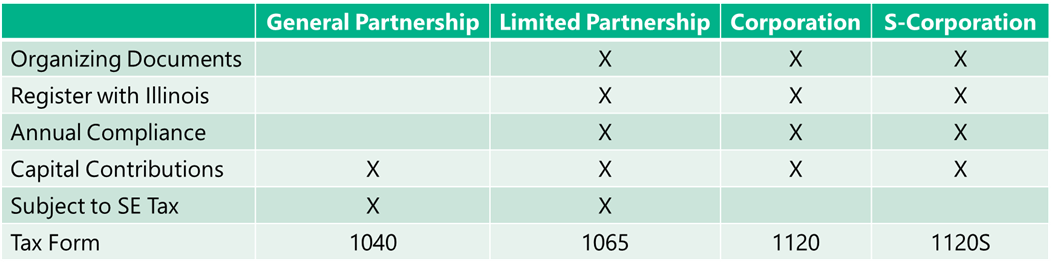

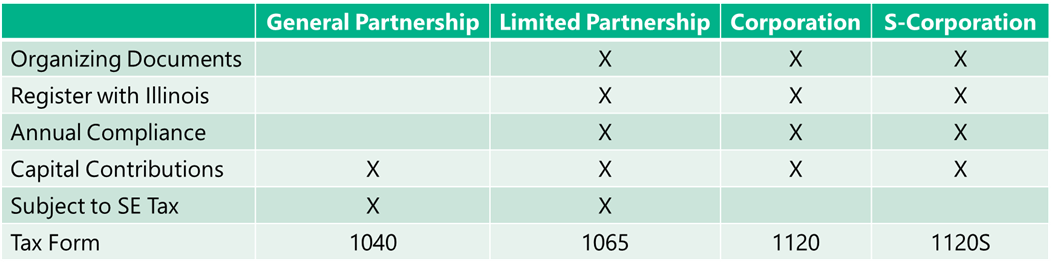

Each entity structure has its own set of start-up procedures, compliance and tax implications; please see Table 1 for a brief overview of general requirements for each entity type.

Table 1: Requirements for Entity Structures

Steps to Creating Your Entity

1. Select your company name

2. File Articles of Incorporation (Corporation) or Articles of Organization (LLC)

a. $150 routine filing fee (can pay an additional $100 for expedited processing) – Corporation

b. $150 routine filing fee (can pay an additional $100 for expedited processing) – for most LLCs

c. Must pay by credit/debit card

d. Illinois Secretary of State payment processing fee is 2-3%

3. Apply for an EIN through the IRS website

a. Lawyer or Accountant can assist in applying for your EIN

b. https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

4. Open a bank account

a. Use the new EIN for your entity

5. Complete By-Laws (Corporation) or Operating Agreement (LLC)

a. Having your business arrangements and agreements written in black and white diminishes the possibility of future conflict with business partners.

Record Keeping

Your newly formed entity will have its own set of records that will need to be tracked accordingly. These records will be used to complete any necessary tax filings. Some entities create a corporate veil of liability protection for their owners (LLC, C-Corporation, S-Corporation). The corporate veil provides a barrier between your personal assets and those of the business. That veil of protection can be “pierced” if you co-mingle personal transactions with the entity’s transactions. An example would be buying a personal pool using the entity’s bank account. If that happens, your personal assets could be at risk during litigation against your business entity. This issue can be prevented by taking appropriate distributions, salaries or dividends from your entity to pay for personal expenses.

Conclusion

The process can be challenging but very manageable with proper planning and assistance. At times, entities can help reduce the risk to your personal assets. Keeping good records is extremely important for entity owners. Forming an entity is an important decision and one that requires careful consideration and planning. It is important to consult with your tax and legal professionals in order to determine the best course of action for your business.