This year’s planting season created several challenges, not just for Illinois soybean producers, but for growers across the country. There have been several reports of strong corn and soybean yields throughout the state, however there are regions and isolated areas where performance was challenged due to regional stresses. The Federal Crop Insurance Program is a risk management tool that can help mitigate financial losses for U.S. farmers, like those that may have been sustained this year.

In 1996, the Risk Management Agency (RMA) was established to administer the Federal Crop Insurance Program. RMA is an agency of the USDA that establishes policy and loss adjustment procedures. Private insurance companies deliver and service individual crop insurance policies.

Here are a few crop insurance reminders as you finish harvest and begin preparations for 2020.

From a claims perspective, Dec. 10 is an important date as this is the end of the insurance period for both corn and soybeans. If you don’t think you’ll be done with harvest by this date, you should contact your crop insurance agent to file a notice of loss and request additional time to harvest. Also, with yields generally down this year, lower yields coupled with a lower harvest price for revenue protection policies could trigger a claim and it’s your responsibility to file that claim.

Three proactive steps to take during or after harvest:

1. Contact your crop insurance agent.

a. If you aren’t sure whether you have a claim, contact your agent to review your policy

b. Winter is the perfect time to look at your farming operation and review your crop insurance policy to make sure it meets your 2020 needs prior to the Mar. 15 sales closing date.

2. Review the type of policy that you purchased.

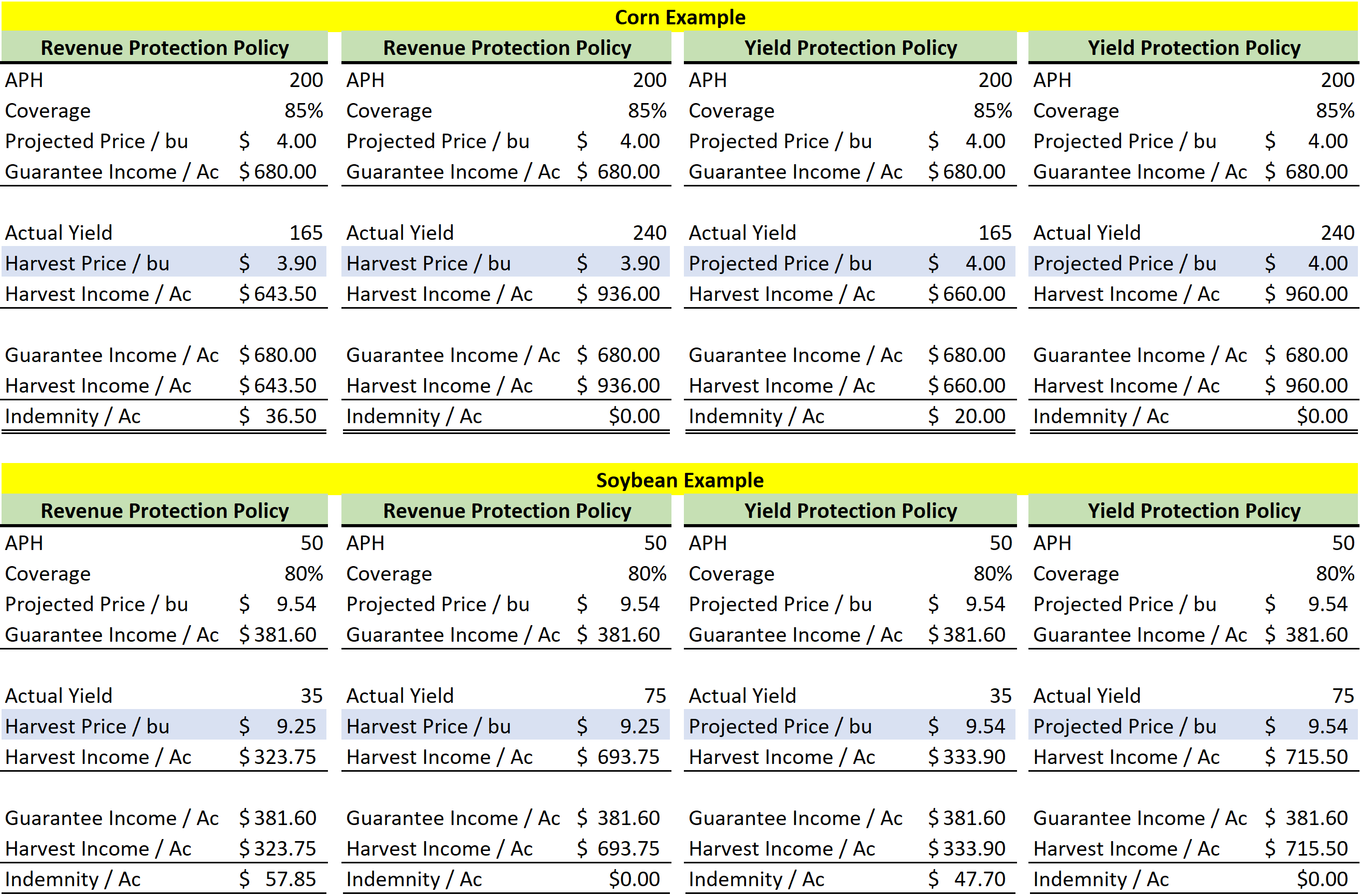

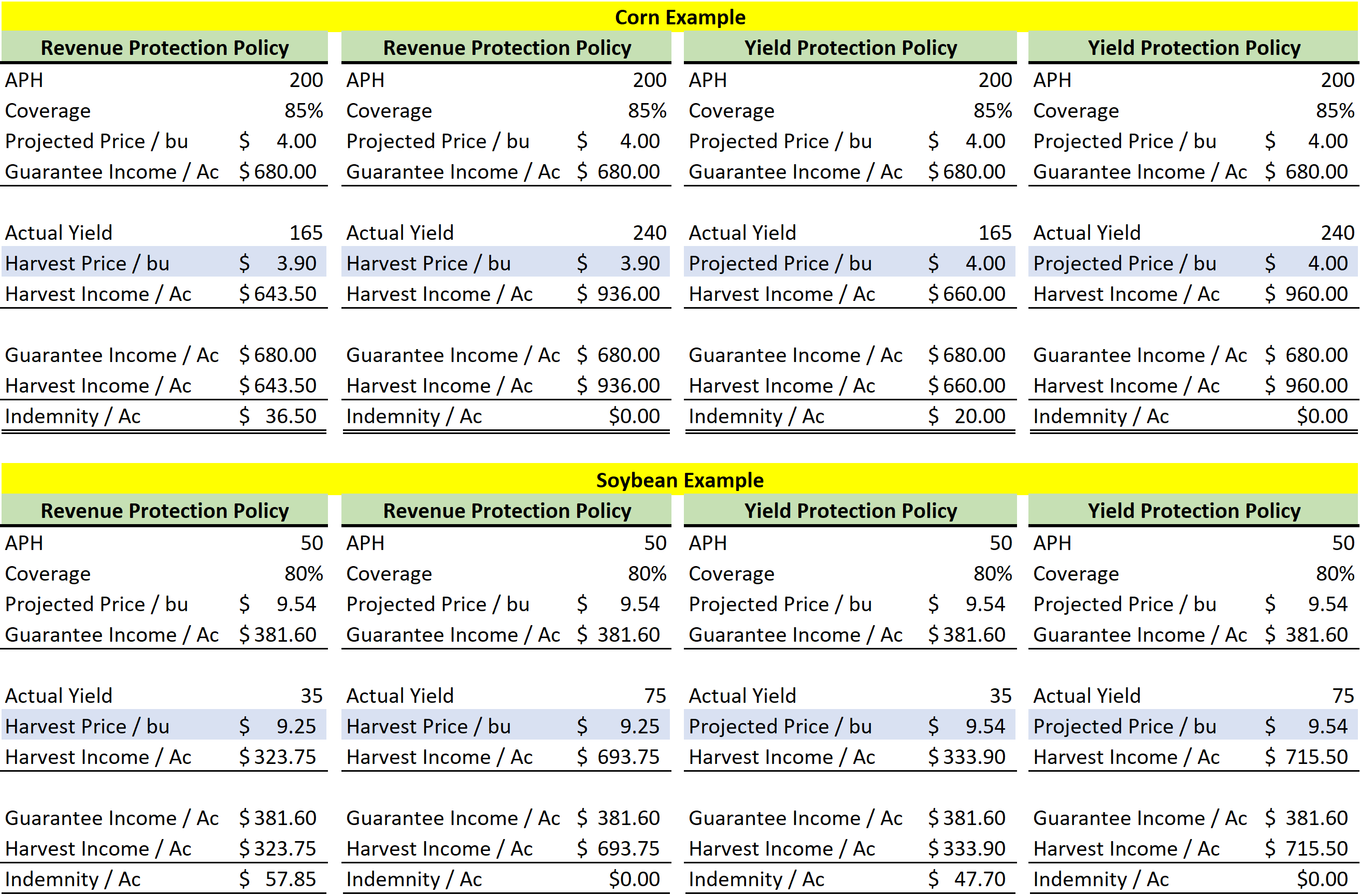

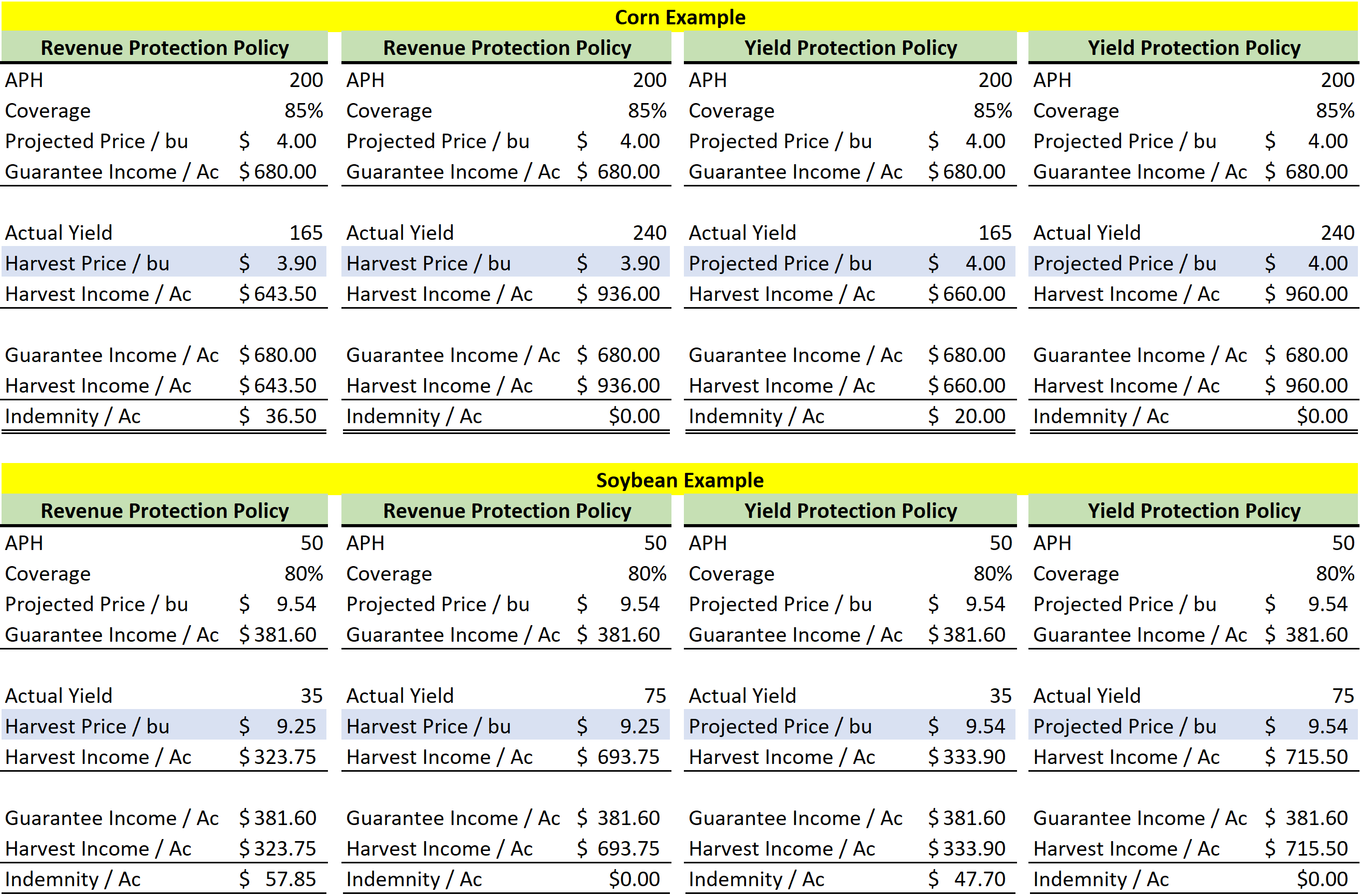

a. Yield Protection: Coverage and any applicable claims will be based on the projected price. Harvest price does not apply. Your policy would only qualify for a claim if unit crop production falls below the established guarantee.

b. Revenue Protection: The amount of insurance coverage is based on the greater of the projected price or the harvest price. If the harvested crop, plus any appraised production multiplied by the harvest price, is less than the amount of insurance protection, the producer is paid an indemnity based on the difference. https://www.rma.usda.gov

c. Revenue Protections with Harvest Price Exclusion: Coverage will be based on the project price. You may qualify for a claim if your total unit production (harvested plus any appraised amount) multiplied by the harvest price is less than the established guarantee.

d. Prices:

i. Corn:

1. The Projected Price was set at $4.00/bu based on the average daily Chicago Board of Trade (CBOT) December 2019 futures price for the month of February 2019.

2. The Harvest Price was set at $3.90/bu based on the average daily CBOT December 2019 futures price for the month of October 2019.

ii. Soybeans:

1. The Projected Price was set at $9.54/bu based on the average daily CBOT November 2019 futures price during the month of February 2019.

2. The Harvest Price was set at $9.25/bu based on the average daily CBOT November 2019 futures price during the month of October 2019.

3. Review your Unit Structure.

a. Basic, optional, or enterprise

b. Review total bushel production based on your selected unit structure.

See additional examples below:

(Note: Information in the chart below was sourced from Additional Resources)

Additional Resources:

USDA Bulletin Releasing Projected Prices:

USDA Bulletin Releasing Harvest Prices:

RMA Information Reporting System (will provide a spreadsheet listing every county):

Actuarial Information Browser (used to look up information for a specific county/crop):

Price Discovery Tool: